Payment & Tax

Pay With Credit/Debit

When you pay with a credit or debit card, you need the name printed on the card, the card number, the month and year the card expires, and the 3-digit or 4-digit security code.

This information, along with the billing address for the credit card, must be entered during the purchase process.

We do not save your credit/debit card number or personal information entered into the payment fields when you make a payment. For questions regarding your transactions on your credit/debit card, please consult the bank that issued your credit/debit card.If you pay by credit card, your payment could be somehow denied at the checkout by our system in defense against possible credit card fraud. It's a good idea to call your credit card company or bank ahead of time to let them know about the purchase so that it doesn't get declined.

If you encounter this situation, unfortunately, please switch to your other credit/debit cards. Or please use the PayPal payment method without a PayPal account.

Pay With PayPal

1. Pay with PayPal account:

When you choose to pay for an order via PayPal, you will be redirected to the PayPal payment page, where you can log in with your PayPal username and password.

2. Pay without PayPal account:

If you do not have a PayPal account, or if you do not want to use your PayPal account, you may still pay via PayPal, by clicking on the "Pay with Debit or Credit Card" option on the PayPal payment page, and you will be redirected to a secure page where you can first enter your email address and then enter your credit card information to complete your payment safely via PayPal.

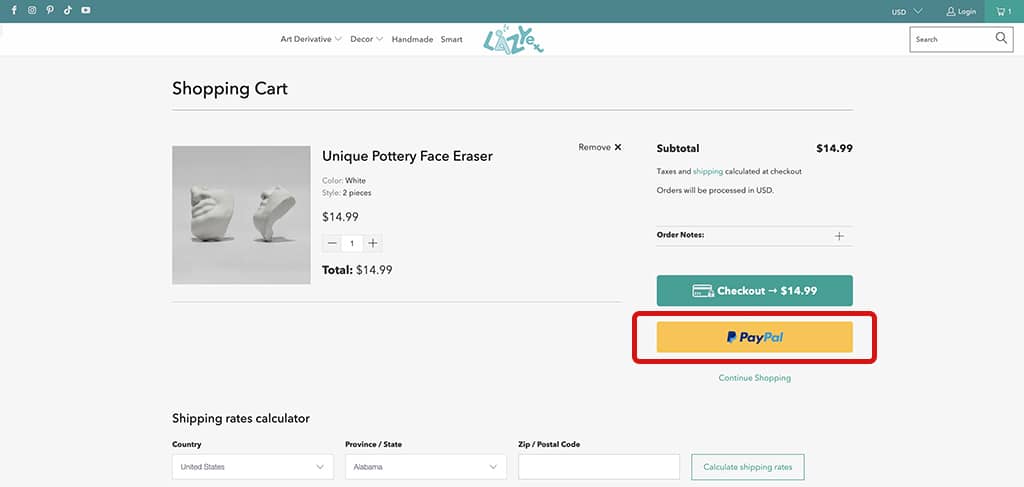

Pay without Paypal account steps:

Step 1. Select PayPal

Step 2. Pay with Debit or Credit Card > Enter your email > Continue to Payment.

Step 3. Fill in your credit card information and complete your order.

Sales Tax

- Sales Tax is calculated on the net total merchandise value after all applicable discounts have been applied. Total taxes may also include taxes charged on delivery and shipping fees (if taxable in your state). The sales tax charged on your order will be displayed at the checkout stage. You will see the Sales Tax applied to your order once you confirm your shipping details and proceed to checkout.

- In case of returns and/or refunds, the appropriate Sales Tax will also be refunded.